avalara tax codes canada

FR020000 Shipping only not paid directly to common carrier Charges for shipping of product through a third-party common carrier paid to the seller. TaxCode the Avalara Product Tax code for the variant.

Its important to note that there is a maximum of 100000 items per import.

. The charges represents the cost of. Most Avalara tax codes are made up of eight characters. The rules for GST broadly follow the European Union and OECD.

15 rows There is the provision to pay quarterly installments for businesses on Annual Returns. Canadian GST PST and QST rates Canadian Federal GST is charged at 5. Canada to tax non-resident sales of digital products and more North America Feb 25 2021 How to ensure the right sales tax rate is applied to each transaction.

We publish tables based on our latest. 159 rows To ensure accurate tax calculation Avalara recommends that you use the 3-letter ISO International Organization for Standardization codes for countries and the 2. Choose Build a taxability matrix.

If you dont sign in on the Avalara Tax Codes Search screen you will not see the Taxability matrix tab. FR020100 Shipping only common carrier - fob destination Charges for delivery of product through a third-party common carrier paid to the seller where the title to the product is transferred at. Optional for other rule types.

This is combined in. AvaTax keeps track of the different tax types for you as long as you add the provinces where your company does business to your company profile. Download Select the states in which you do business.

Find the average local tax rate in your area down to the ZIP code 1. Two letters to start and six numbers at the end. Access a database of tax content rates.

Canadian GST PST HST QST Canada operates a range of Goods Services Tax GST across the Federal and 13 Provinces. The first letter indicates the tax code type P for products D for digital. If you must map more than 100000 SKU codes to.

Only Tax codes Recommended Groupings Item Types Goods Services PC040405 Clothing and related products business-to-customer-gym suits PC040502 Clothing and related products. Only Tax codes Recommended Groupings Item Types Goods and services Services FR020900 Shipping charges that exceed reasonable and prevailing rates Charges for shipping only that. Select the Taxability matrix tab.

Connect with Avalara for more accurate rates to help you do tax compliance right Call 877-286-2149 Schedule a call Chat Chat with a specialist Customer support chat. To that end there are pre-populated customer taxability profiles present in the AvaTax system with rules for the United States and Canada. THE AVALARA PLATFORM A reliable secure and scalable tax compliance platform Leverage cloud-native software from a tax compliance leader.

An Avalara tax code or custom tax code indicating the category of product service or charge. Text 25 Required for entity use rules. Federal government United States State.

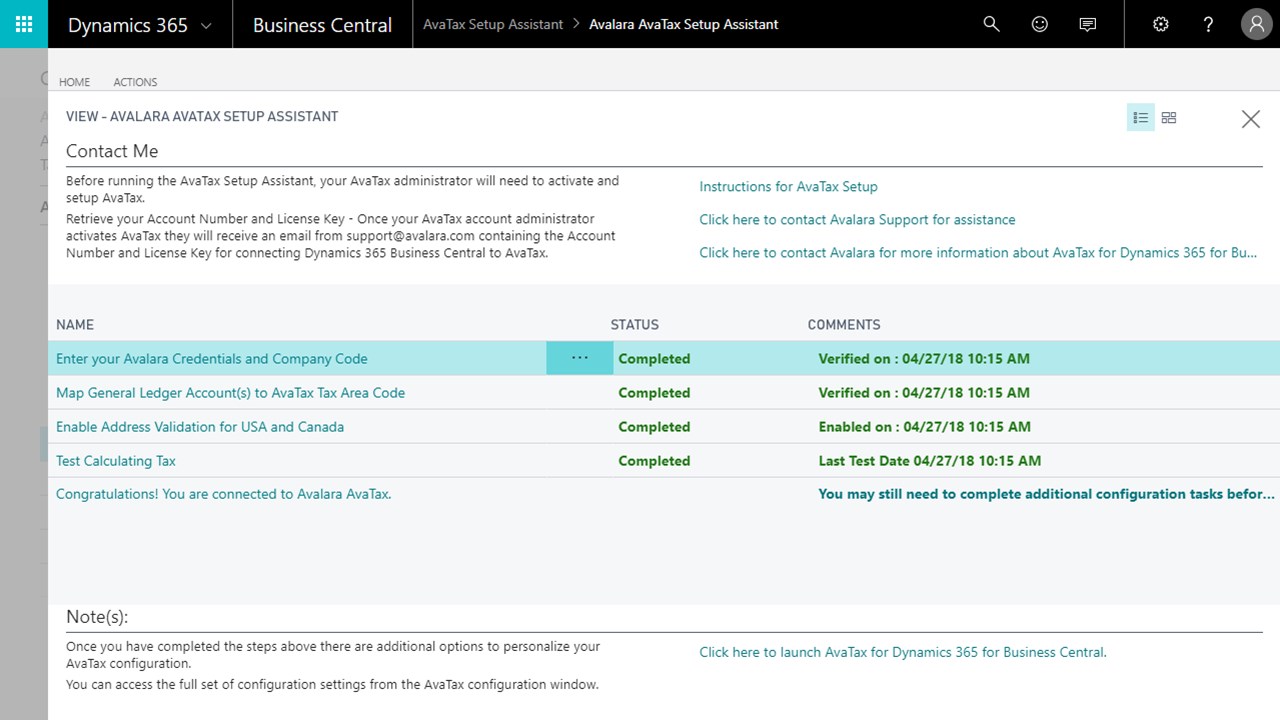

Setting Up Avalara Avatax Groupon Goods Marketplace

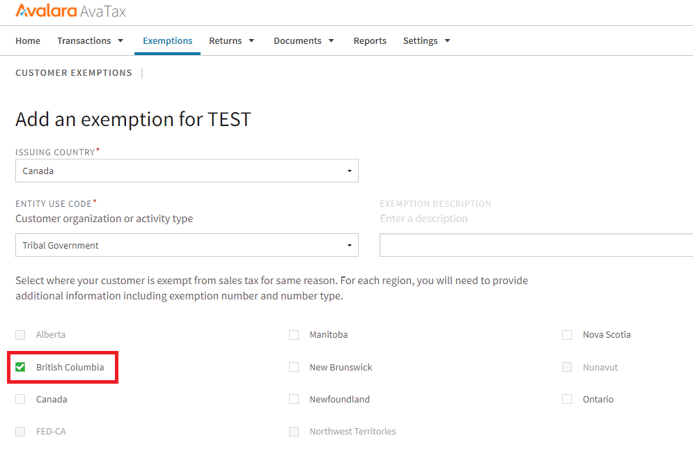

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Map The Items You Sell To Avalara Tax Codes Avalara Help Center

Wix Stores Creating Tax Groups For Products With Avalara Help Center Wix Com

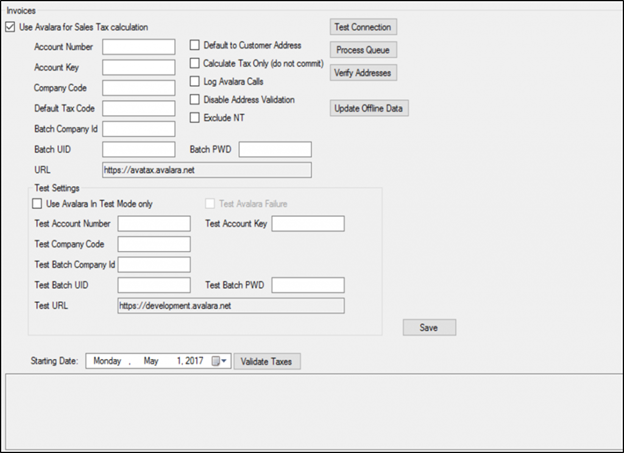

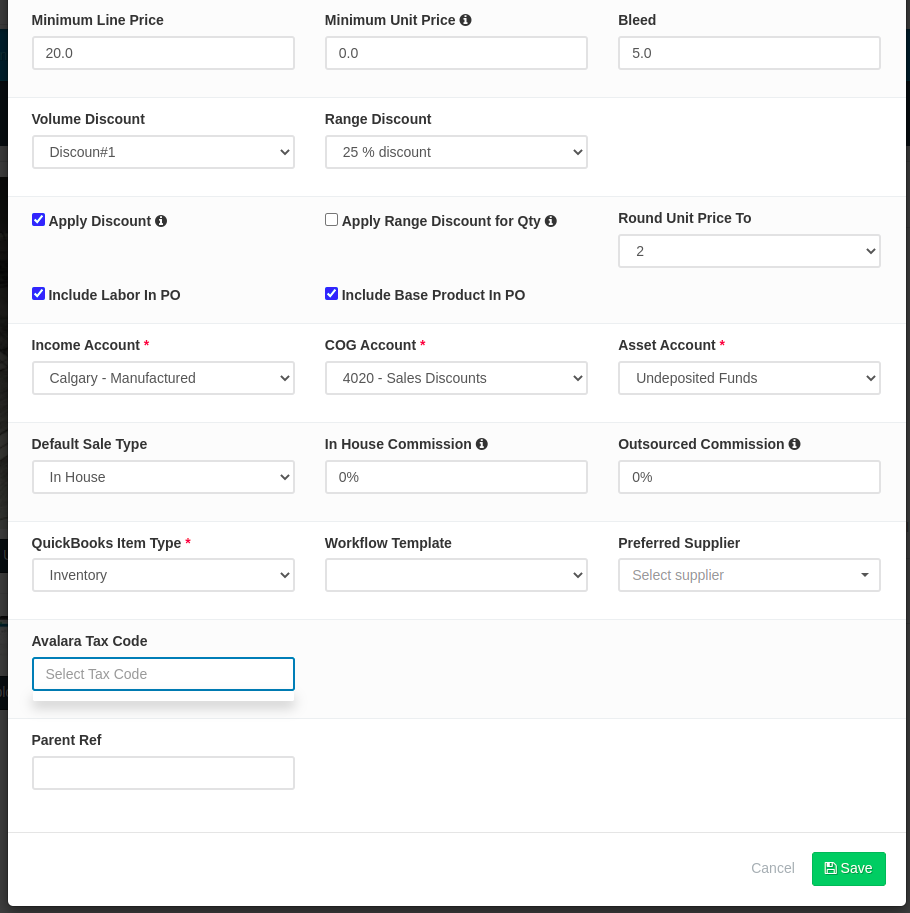

Avalara Avatax Sales Tax Setup Guide Shopvox Help Center

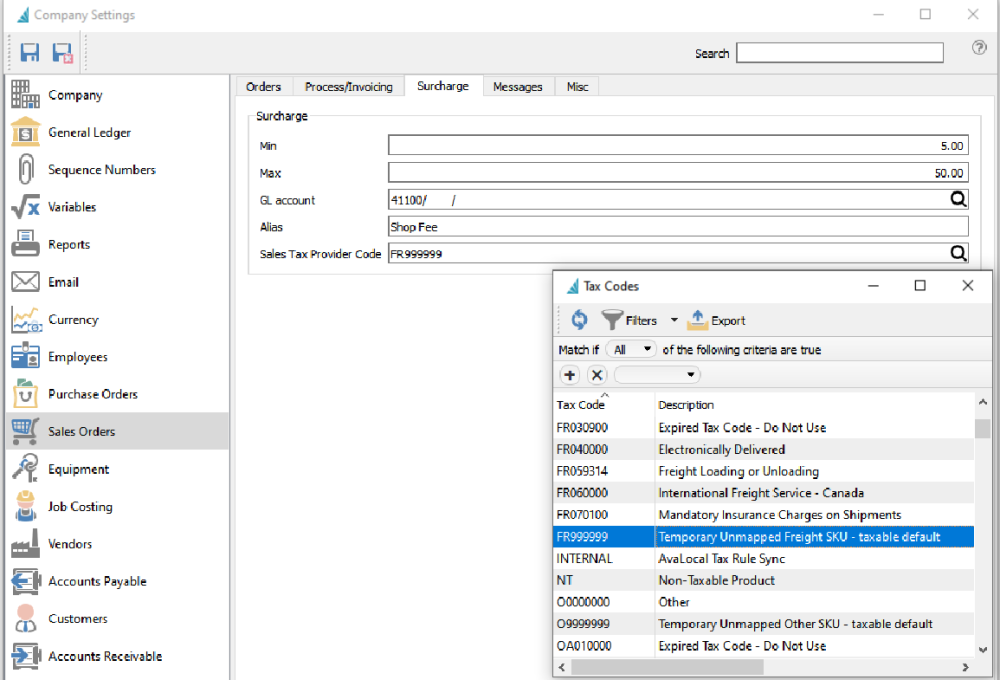

Avalara Sales Tax Spire User Manual 3 5

Sage Sales Tax Powered By Avalara Sage Us Marketplace

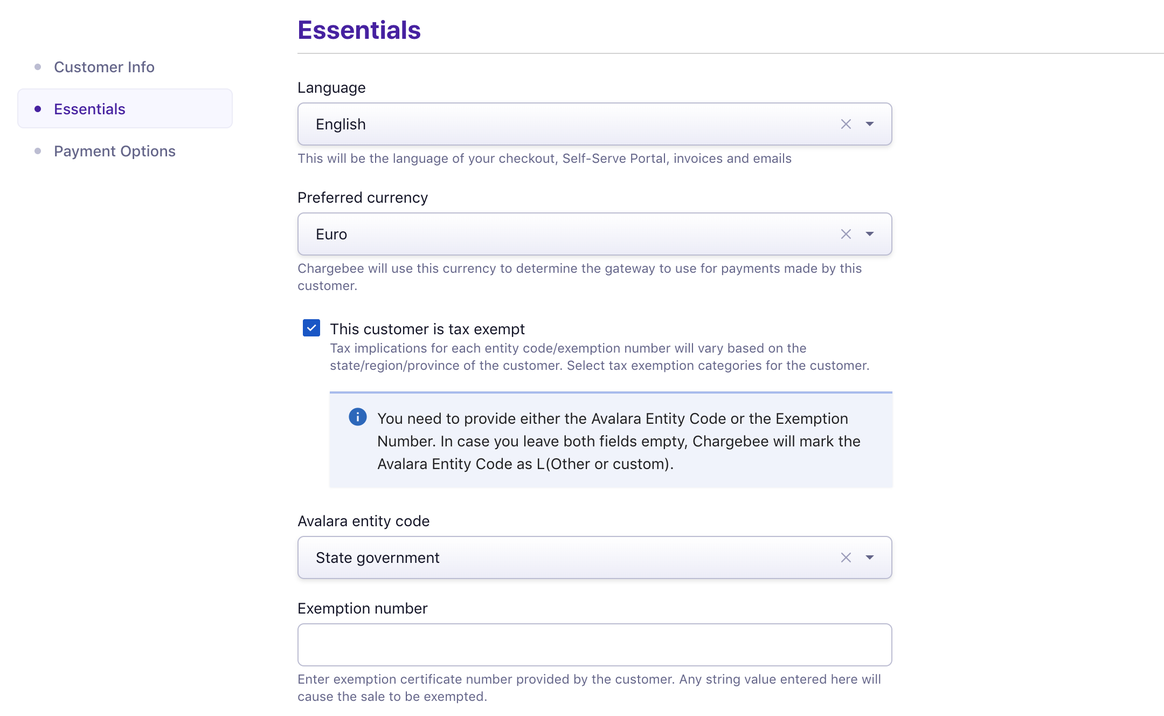

Avatax For Sales Chargebee Docs

How Taxjar Avalara Taxamo And Quaderno Compare For Sales Tax Compliance By Quaderno Medium

Avalara Tax Service Aria Developer Central

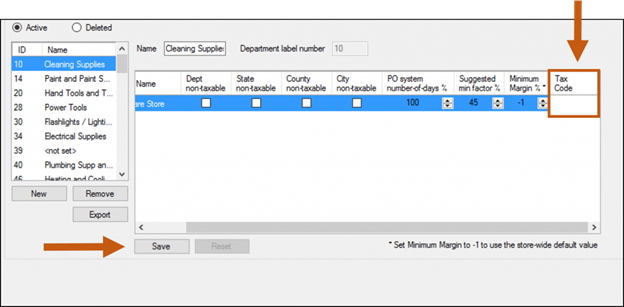

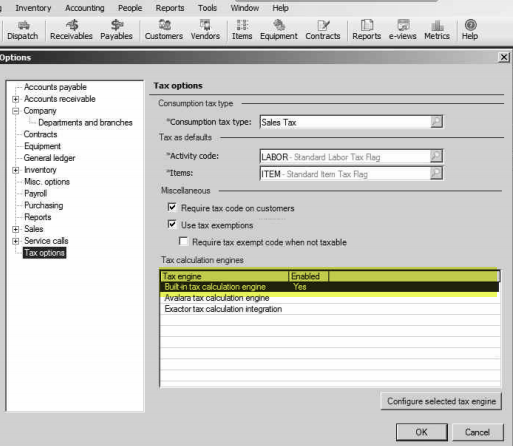

Best Practices Setting Tax Option In Eautomate Overview And Sample Ceo Juice